This article is cited from BIMCO website and the author is Mr. Peter Sand.

Overview

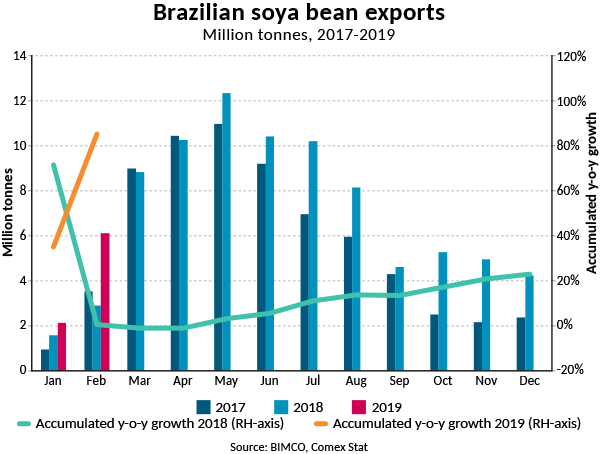

Brazilian soya bean exports are up 85.2% in the first two months of 2019, compared to the same period in 2018. This comes on the back of record high exports in 2018 of 83.6 million tonnes, a 22.7% increase from 2017.

2019 has seen the highest ever export of soya bean during the month of February. Exports totalled 6.1 million tonnes, a 112.6% increase from the 2.9 million tonnes exported in February 2018. Strong demand, in particular from China, the world’s largest soya bean importer, and an early harvest are behind this large increase.

“As predicted by BIMCO earlier in the year, Brazilian soya bean exports started earlier this season, with much higher exports in particularly in February. Brazil has managed to ramp up its exports to China in response to its increased demand for non-US soya beans following the start of the trade war,” says Peter Sand, BIMCO’s Chief Shipping Analyst.

Of the 8.2 million tonnes exported by Brazil in the first two months of 2019, 7 million tonnes have been sent to China, twice as much as was sent in the first two months of 2018 (3.5 million tonnes). The proportion of Brazilian soya bean exports going to China has been increasing in recent years, from 32% in 2005 to 82.3% in 2018.

Increased exports bring some relief to the dry bulk market

Compared to the first two months of 2018, Brazilian soya bean exports have employed an extra 51 Panamax loads (75,000 tonnes) or 3.8 million tonnes. Of these, 47 loads (3.5 million tonnes) are sailing to China, further increasing the tonne mile demand generated by Brazilian soya bean exports.

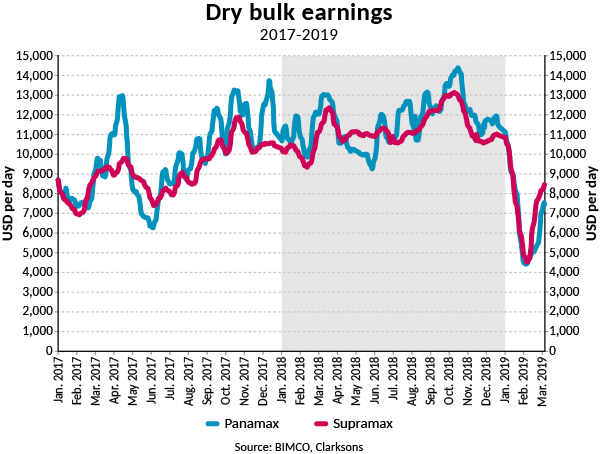

“The recent upturn in Panamax and Supramax earnings is likely to be linked to the start of the Brazilian soya bean exporting season. The large volumes being exported, in particular to China have driven up the demand for the mid-sized dry bulk vessels,” says Peter Sand.

Mid-February saw the Baltic Dry Index fall to 595, and although Capesize earnings have continued to fall, the smaller vessel sizes seem to have overcome the worst. Panamax earnings are up from USD 4,435 per day on 4 February 2019 to USD 7,454 per day on 7 March 2019. Similarly, Supramax earnings rose from USD 4,544 per day on 6 February 2019 to USD 8,474 per day on 7 March 2019.

2018 record unlikely to be broken in 2019

Since 2016, total Brazilian exports have grown year on year, but this is unlikely to be the case in 2019. Production of soya beans is expected to be lower and with many stocks already depleted, the supply of Brazilian soya beans will most likely not match the level seen in 2018.

Exports of soya beans from the US may, in contrast to Brazil’s exports, rise. Given the disappointing US soya bean exports since the start of the trade war, stocks there are high, and should Chinese buyers return, the US would be able to continue exporting through its off season which runs from now until the start of September.

An ending of the trade war and/or further commitments by the Chinese to increase their imports from the US would likely lead to the return to a more usual seasonality than seen during the second half of 2018 and the start of 2019.